Latest Entries »

Late August, 2010 Apple was trading at $240.28 and two months later it is created a new high of $318.00 but settled for $307.47 by the end of this week. That is a 28% jump in just two months, so what was the reason for this run-up, yeah you guessed it right iPad and iPhone 4, antenna gate or no antenna gate, Apple knows what to make and can create customer demand. Approximately 3.3 million iPad’s and 14 million iPhones were sold.

Similarly, Amazon was trading at $123.79, and two months later it is created a new high of $169.13. That is a 36.6% jump in just two months and the reason is Kindle and Amazon Prime.

So what is so unique about these two companies?

- Company – Both Apple and Amazon are tied to their founders and are mirror image of their founders Steve Jobs and Jeff Bezos. Both are generating lot of free cash flow and are growing exponentially and have strong brand presence.

- Customers – Both Apple and Amazon customers are more tech savvy than the general public. They know what each brand brings and are loyal to the brand.

- Competition – Even though people are not thinking of Amazon and Apple as competitors, they are going to be going head on in the near future. But for now the focus is on the traditional competitors.

Apple has started grabbing market share in the PC market from Microsoft and has a huge lead over Google in the mobile phone industry and killed Microsoft in personal entertainment devices (music and video players). iPad is becoming a huge hit and Apple is skimming the market.

Amazon on the other hand has killed all the startup’s that were trying to follow it’s lead into ecommerce. It has a virtual monopoly in online sales as a retailer. Traditional stores (Babies ‘R’ Us, Rockport, Wilson’s Leather, Radioshack and others) forming joint ventures like ShopRunner to compete against Amazon Prime is too little too late. Amazon has diversified into lot of different areas from cloud computing to delivering groceries. It has a strong market presence.

- Context – Both companies are at forefront of the market and are extremely successful at this point. They are primed to be competing in the e-book market, which is having huge growth as people are shifting from paper books to e-books.

- Innovation – Both companies are known innovators, while Apple is innovative in the gadget and computer design, Amazon has revolutionized the way we do commerce and is doing lot of vertical and horizontal integration and making customer service and satisfaction top priority.

Amazon introduced Kindle in November 2007 and was the first e-reader to hit the market. The second competing e-reader was launched by Barnes & Nobel in November 2009, after the second generation of Kindle was released (February 2009).

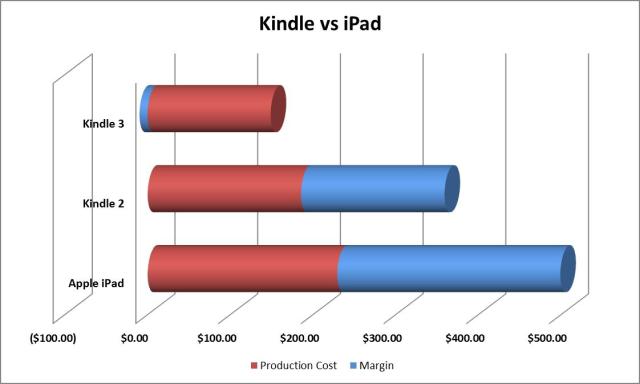

For two years Amazon skimmed the market and Kindle became cash cow for the company. Amazon dropped the price of Kindle 2 and undercut Nook price. In the last three months, the price war escalated in part because of other players coming into the market and because of iPad. Kindle 3 under cut Nook by a $10 and I believe Amazon is selling Kindle at a loss from production costs, not to mention marketing and SGA costs. Amazon is going for market penetration and is willing to take short term pain for long run gain and customer satisfaction. It sees that Kindle store will provide the long term gain if they tie customers to Kindle.

Kindle is an e-reader and that was the decision made by Jeff Bezos, not to make it a tablet. He believes that there is a significant market for the e-readers, the technology used e-ink is similar to reading on a piece of paper, with no glares and can be read in bright sunlight. Kindle 3 battery life is about a month and with new capabilities like lending e-books, PDF support, it does not lack in technology for e-readers. The biggest advantage Kindle has over Apple is the head start in number of e-books offered on Kindle book store. To further compete, Amazon entered a deal with Best Buy to start selling Kindle in stores, which was targeted not only at Barnes and Noble but also at iPad.

iPad on the other hand is a tablet, an over sized iPhone without the phone capability. It is not a huge technological leap but more of a customer perception leap. It is not ready to replace the laptop, but its so lid sales number in Q3 quarter shows that the tablets are here to stay. Like Amazon, Apple has a huge leap over competition in tablet with competition scrambling to put together a tablet and get into the market. Microsoft has shown in early 2010 a tablet but for all the talk they got one tablet out with HP in October 2010 and is only targeted to businesses. Apple is currently skimming the market.

Apple came late to the book agreement and has few books to offer allowing Amazon to reach a much wider audience and once people start buying books on Kindle store, the moving costs will keep the customers from leaving. Total customer life cycle value is higher than the initial purchase and Apple has left a door open for competitors to sneak in. It has ignored to involve Barnes and Noble to provide a counter to Amazon and instead trying to build its own book store which is way behind Amazon in the number of targets.

Amazon stated that Kindle sales for Q3 and ongoing Q4 sales are much higher than last year same quarter sales and are the best selling Kindles. This indicates that there will not be price reduction before the holiday shopping but expect Kindle base model price below $100 sometime early next year. Apple will continue to skim market for the near future, until some rival tablets are introduced in the market by it’s competitors. I see both devices becoming an important strategic brand for their companies in the future.